As a trader, timing is everything. Knowing when to enter and exit trades can mean the difference between a profitable or unsuccessful outcome. Even the most experienced traders sometimes struggle with this aspect of the trade. However, mastering the art of timing can bring immense benefits to your trading portfolio. In this blog post, we’ll explore some vital tips on how to know when to enter and exit trades to maximize your profits and minimize risks. Whether you’re new to trading or a seasoned pro, this article is for you. Read on to learn more.

The Art Of Timing In Trading

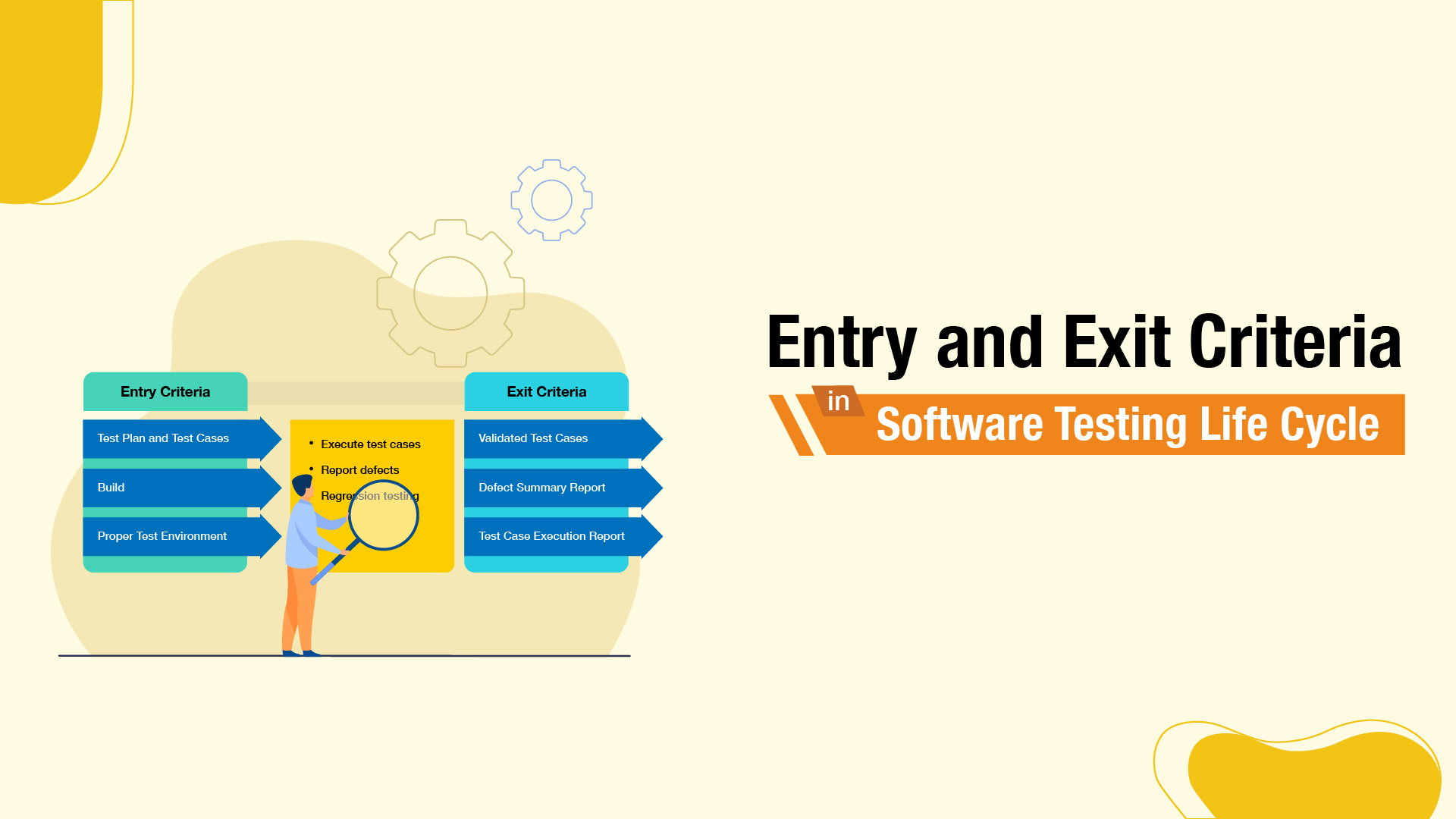

Timing plays a crucial role in trading, and mastering the art of timing can greatly enhance your success in the market. But what exactly is the art of timing? In trading, it refers to knowing when to enter and exit trades to capitalize on market movements. It involves understanding market cycles, identifying key support and resistance levels, analyzing market indicators, conducting thorough fundamental analysis, and evaluating market sentiment and news.

By mastering the art of timing, you can increase your profitability and reduce your risk. It requires a combination of technical analysis, fundamental analysis, and an understanding of market dynamics. With the right strategies and techniques, you can effectively time your trades and make informed decisions.

In this guide, we’ll explore the various aspects of the art of timing and provide actionable tips to help you improve your trading skills. Whether you’re a novice trader or an experienced one, this guide will serve as a valuable resource to enhance your trading performance.

:max_bytes(150000):strip_icc()/NVDAchart-8b140b06bf1f4d148bdd1454b40da431.jpg)

Importance Of Knowing When To Enter And Exit Trades

Knowing when to enter and exit trades is crucial for successful trading. It can determine whether you make a profit or suffer a loss. By understanding the importance of timing, you can maximize your returns and minimize your risks. Timing your trade entry allows you to enter at optimal price levels, increasing the chance of profitability. On the other hand, knowing when to exit a trade helps protect your gains and limit your losses. It allows you to lock in profits and cut your losses before they escalate. Ultimately, mastering the art of timing in trading is essential for achieving consistent success in the market.

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Timing_Tips_Every_Investor_Should_Know_Jul_2020-02-557b3c9d831f41f2b7029cbb8b2e736d.jpg)

The Basics of Timing in Trading

Understanding market cycles and trends

Understanding market cycles and trends is crucial for successful trading. Market cycles are patterns that occur in the financial markets, characterized by periods of expansion, contraction, and consolidation. By identifying these cycles, traders can make informed decisions about when to enter and exit trades. Trends, on the other hand, refer to the general direction in which the market is moving. By analyzing trends, traders can determine whether the market is bullish, bearish, or ranging. This knowledge helps traders determine the best strategies to employ at different stages of the market cycle. It is important to stay updated with market news and use technical analysis tools to identify these cycles and trends accurately.

Identifying key support and resistance levels

When it comes to trading, one of the most important skills to master is identifying key support and resistance levels. These levels play a crucial role in determining market psychology and supply and demand. Support occurs at price levels where demand is strong enough to prevent further price declines, while resistance occurs at price levels where supply is strong enough to prevent further price increases. By pinpointing these levels on a price chart, traders can make more informed decisions about when to enter or exit trades. The key is to look for areas where price has previously paused or reversed, indicating a concentration of buying or selling pressure. This can be done using tools such as trendlines, moving averages, and pivot points. With practice and experience, traders can become better at identifying these levels and using them to their advantage in the market. So, if you want to improve your trading skills, mastering the art of identifying support and resistance levels is a must.

Analyzing market indicators and oscillators

When it comes to analyzing market indicators and oscillators, there are a few key steps you should follow. First, understand the concept of these tools and how they can help you identify market trends and momentum. Then, familiarize yourself with specific indicators and oscillators and how they are calculated. Next, learn how to interpret the signals they generate, whether it’s indicating overbought or oversold conditions, or potential trend reversals. Finally, remember to use these signals in conjunction with other technical analysis tools and indicators for a more comprehensive view of the market. By mastering the art of analyzing market indicators and oscillators, you’ll be better equipped to make informed trading decisions.

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-03-c486502955624f54a90ce7d9ce3b7a16.jpg)

Factors to Consider when Entering Trades

Conducting thorough fundamental analysis

Are you interested in learning how to conduct a thorough fundamental analysis? Look no further! In this guide, we will explore the step-by-step process of analyzing a company’s financial positions and performance, as well as the market in which it operates. We will delve into the importance of studying the company’s financial statements, such as the income statement, balance sheet, and cash flow statements. Additionally, we will discuss how to calculate key ratios and use industry data and economic factors to forecast future growth rates. By the end of this guide, you will have a clear understanding of how to effectively conduct fundamental analysis and make informed investment decisions. So let’s get started on this exciting journey of financial analysis!

:max_bytes(150000):strip_icc()/dotdash_Final_Stochastics_An_Accurate_Buy_and_Sell_Indicator_Oct_2020-01-61f4fc026ca648db862f4757e87a3261.jpg)

Examining technical indicators

Examining technical indicators is an essential step in knowing when to enter and exit trades. These indicators provide valuable insights into market trends and can help traders make informed decisions. When examining technical indicators, it is important to consider factors such as moving averages, volume, trend lines, and oscillators. Moving averages help identify the overall direction of the market, while volume indicates the strength of a trend. Trend lines provide support and resistance levels, and oscillators help identify overbought or oversold conditions. By analyzing these indicators, traders can gain a better understanding of market dynamics and make more accurate predictions.

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-012-c113b470062745f098d9ca585bf2caf2.jpg)

Evaluating market sentiment and news

Evaluating market sentiment and news plays a crucial role in timing your trades effectively. By understanding the overall market sentiment and staying informed about the latest news, you can make more informed decisions. Start by monitoring financial news sources and reputable websites to get a sense of the current market sentiment. Pay attention to the tone of the news articles and analyze how it might impact the market. Additionally, keeping an eye on social media platforms and forums can give you insights into investor sentiment. Look for patterns and trends in discussions and posts to gauge market sentiment. Remember, no single news article or social media post should be the sole basis for your trading decisions. Instead, use these sources as part of a comprehensive analysis that includes other technical and fundamental indicators. Stay up to date with market news to improve your timing skills.

:max_bytes(150000):strip_icc()/dotdash_Final_The_Anatomy_of_Trading_Breakouts_Jun_2020-02-7a24b06063574c5e84a53704e53b7a2f.jpg)

Timing Techniques for Entering Trades

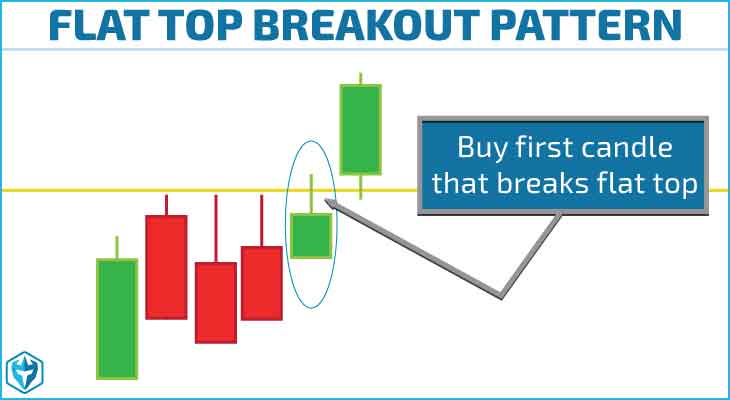

Breakout trading strategy

If you’re interested in breakout trading strategies, here’s a simple guide to get you started. Breakout trading involves identifying key levels of support and resistance and entering trades when the price breaks through these levels. The idea is to catch the momentum of the breakout and ride the trend for potential profits. To implement this strategy, you’ll need to analyze price charts and identify strong support and resistance levels. Once you’ve identified these levels, you can set entry and exit points accordingly. It’s important to note that breakout trading carries risks, so it’s essential to use appropriate risk management techniques such as setting stop-loss orders and take-profit targets. With practice and continuous learning, you can master the art of breakout trading and potentially achieve profitable trades.

:max_bytes(150000):strip_icc()/dotdash_Final_Swing_Trading_Definition_and_Tactics_Sep_2020-01-4a6d22bec15342ed8ad60170afda74ca.jpg)

Swing trading strategy

Swing trading is a popular strategy among traders who aim to capture gains over a few days to several weeks. The idea behind this strategy is to enter the market at a swing low and exit at a swing high, taking advantage of price movements within a trending market. One advantage of swing trading is that it requires less time compared to day trading, making it suitable for those with busy schedules. It also allows traders to take advantage of larger price swings, resulting in potentially higher returns. However, it’s important to note that swing trading may not offer as many trading opportunities compared to day trading, which requires discipline and patience. By following a well-defined swing trading strategy, traders can increase their chances of success in the market.

Momentum trading strategy

The momentum trading strategy is an approach that focuses on stocks that are moving with strong upward momentum. As a momentum trader, the goal is to find stocks that have the potential to make big moves, typically 20-30% or even more in a single day. This strategy involves scanning the market for stocks that meet specific criteria, such as having strong daily charts, high volume, and a fundamental catalyst. Once a potential trade is identified, the trader looks for entry points on pullbacks and sets tight stop losses to manage risk. The momentum trading strategy requires skill and the ability to spot patterns in real-time, but when executed correctly, it can lead to substantial profits.

:max_bytes(150000):strip_icc()/risk_management-5bfc36abc9e77c005182400f.jpg)

The Role of Stop Loss and Take Profit Levels

Setting appropriate stop loss levels to manage risk

Setting appropriate stop loss levels is crucial for managing risk in trading. A stop loss is the predetermined point at which you exit a position to limit your losses. By setting a stop loss, you avoid the risk of significant drawdowns or even a complete account blow-up. To determine the appropriate stop loss level, you need to consider your risk tolerance, position size, and the volatility of the market you’re trading. It’s important not to set the stop loss too tight, as it might trigger unnecessary exits. On the other hand, setting it too wide can result in bigger losses. Finding the right balance is key to managing risk effectively and protecting your trading capital. Remember, trading is about probabilities, and setting appropriate stop loss levels is a vital part of that equation.

Establishing realistic take profit targets to lock in profits

Establishing realistic take profit targets is an essential aspect of successful trading. By setting a predetermined price level to close the trade and lock in profits, traders can effectively manage their risks and maximize their gains. These targets should be based on objective analysis and market tendencies, ensuring that the profit potential outweighs the risk. However, it’s important to strike a balance and avoid setting profit targets that are too far away or too close. Placing profit targets requires skill and consideration of various factors such as support and resistance levels. By establishing realistic profit targets, traders can filter out poor trades and increase their overall profitability in the long run.

:max_bytes(150000):strip_icc()/dotdash_Final_Simple_and_Effective_Exit_Trading_Strategies_Sep_2020-02-2f68c020406d479b9fbf74cbee41f409.jpg)

Importance of adjusting stop loss and take profit levels as the trade progresses

Adjusting stop loss and take profit levels as the trade progresses is of utmost importance in trading. As the market moves, it can either work in your favor or against it. By regularly assessing the market conditions and reevaluating your trade, you can make informed decisions on whether to tighten or loosen your stop loss and take profit levels. This allows you to manage risk effectively and maximize your profits. Additionally, adjusting these levels helps you to adapt to changing market dynamics and avoid being caught off guard by sudden reversals or fluctuations. It is essential to stay vigilant and flexible in your trading approach to optimize your chances of success.

:max_bytes(150000):strip_icc()/dotdash_Final_Simple_and_Effective_Exit_Trading_Strategies_Sep_2020-02-2f68c020406d479b9fbf74cbee41f409.jpg)

Recognizing Signals to Exit Trades

Using trailing stop loss orders

One effective technique in trading is the use of trailing stop loss orders. These orders allow traders to lock in profits as the price moves in their favor. Essentially, a trailing stop loss order adjusts the stop price based on fluctuations in the market, always maintaining a certain percentage below or above the market price. This ensures that traders know the exact minimum profit their position will garner and helps protect against losses. By setting appropriate trailing stop loss levels, traders can manage their risk effectively and maximize their potential profits. It’s important to note that trailing stop loss orders should be used in conjunction with other trading strategies and analysis to make informed decisions.

Analyzing changes in market conditions

Analyzing changes in market conditions is a crucial aspect of timing trades effectively. As a trader, it is essential to stay updated and aware of any shifts in the market that could impact your investments. By monitoring market conditions, such as economic indicators, geopolitical events, and industry news, you can make more informed decisions about when to enter and exit trades.

For example, if there is a sudden change in government regulations or a significant announcement from a company, these factors can greatly influence the market. By conducting thorough research and analysis, you can identify potential opportunities or risks and adjust your trading strategy accordingly.

Additionally, by utilizing technical analysis techniques like studying price patterns and indicators, you can gain insights into market trends and identify potential trend reversals. This information can be invaluable in determining the optimal timing for entering or exiting trades.

In conclusion, analyzing changes in market conditions is a fundamental aspect of successful trading. By staying informed and using factual data to guide your decision-making process, you can improve your chances of timing trades effectively and maximizing your profits.

Applying technical analysis to identify trend reversals

Applying technical analysis to identify trend reversals is a crucial skill for traders. By studying price patterns, chart formations, and indicators, traders can spot potential trend reversals before they happen. Technical analysis tools such as moving averages, trendlines, and candlestick patterns can provide valuable insights into market sentiment and help identify when a trend may be losing steam. However, it is important for traders to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis. It is also essential to continuously learn and practice to refine one’s skills in identifying trend reversals. With dedication and experience, traders can effectively time their trades and capitalize on market movements.

Final Thoughts on the Art of Timing

In this blog post, we have discussed the art of timing in trading and the importance of knowing when to enter and exit trades. We explored various strategies, such as breakout trading, swing trading, and momentum trading, that can help traders make informed decisions. We also highlighted the significance of conducting thorough fundamental and technical analysis, as well as evaluating market sentiment and news. Additionally, we discussed the importance of setting appropriate stop loss levels and establishing realistic take profit targets to manage risk and lock in profits. We touched on the use of trailing stop loss orders and the application of technical analysis to identify trend reversals. Lastly, we emphasized the importance of continuous learning and practice in timing trades. By understanding these key points and implementing effective exit strategies, traders can build confidence, improve trade management skills, and increase profitability.

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-03-c486502955624f54a90ce7d9ce3b7a16.jpg)

Importance of continuous learning and practice in timing trades

Continuous learning and practice are crucial in the art of timing trades. The financial markets are dynamic and constantly evolving, and staying updated with the latest strategies, market trends, and indicators is essential for successful trading. By continuously learning and practicing, traders can improve their skills, gain new insights, and adapt to changing market conditions. Additionally, practice allows traders to refine their timing techniques and develop a keen sense of when to enter and exit trades. It also helps in enhancing risk management skills and decision-making abilities. Ultimately, continuous learning and practice contribute to a trader’s ability to make informed decisions, increase trading profits, and achieve long-term success in the markets.

The art of timing in trading is crucial for success in the financial markets. Timing refers to knowing when to enter and exit trades based on market conditions and indicators. It involves understanding market cycles and trends, identifying key support and resistance levels, and analyzing market indicators and oscillators. Additionally, thorough fundamental analysis and examination of technical indicators are essential. Traders can use various strategies such as breakout trading, swing trading, and momentum trading to take advantage of market movements. Setting appropriate stop-loss levels and realistic take-profit targets is vital for managing risk and locking in profits. Traders should also adjust their stop loss and take profit levels as the trade progresses, and use trailing stop loss orders to protect their gains. Analyzing changes in market conditions and applying technical analysis to identify trend reversals are essential skills for timing trades. Continuous learning and practice in timing trades are crucial for success in the financial markets.

1 thought on “The Art of Timing: Knowing When to Enter and Exit Trades”

Comments are closed.